Financial Records for Students – As a student, you should manage your finances well if you study aboard or live independently away from home. When you start to live independently, you also must be selective in spending money for your daily needs so that your monthly budget is enough for a month's living expenses.

Common problems often start to arise when you finally live independently. One of the primary examples is that students find it hard to manage expenses, mostly to balance spending for needs and daily necessities. Many of you ever struggle lack of funds at the end of the month, right?

Because of that, Whizmin will provide various ways to make financial records so that you can manage your finances in the future. Read more on this article!

Read also: How to Make a Personal Financial Plan, Beginners Must Know!

How to Make Financial Records for Students

1. Record and Create A List of Daily Necessities

Before you spend your money, try to list daily necessities that you will spend for a month. That way, your financial post will become transparent. You will know how much money you must use monthly and how much you can save.

Try to list your primary (main) necessities first—for example, cooking ingredients or other crucial personal needs. Next, you can estimate how much you need for secondary needs, such as funds to hang out with friends.

This list will benefit you because you will become more aware of the very important or less critical needs. For less essential requirements, you should think carefully if you want to spend your money on them.

In addition, you should be OK with the brand of the daily needs you will use. However, pay attention to the quality of the product first so that you can be wiser in making choices and managing finances.

2. Calculate Daily Expenses

You will, of course, spend your money every day. For example, when you go to college, you must pay for transportation fees, lunch fees, or unexpected expenditures.

By calculating how much you will spend on daily expenses, you can control your finances to be more considerate of how you use your money. This method is quite adequate, so you must try it!

3. Paying Bills on Time

As a student who lives independently, you will encounter various bill payments you must pay. Such as water, electricity, and internet (Wi-Fi) fees. You must pay your bill on time and arrive on time.

You will avoid debt if you consistently pay bills on time. If you need to remember the payment due date, try creating a reminder on your calendar or smartphone.

You can mark it on the calendar or smartphone. You will guarantee it won't be anxious if you pay bills on time.

4. Consistently Saving Money

Saving money is the most important activity when you become a student who lives independently. It's for more than just people who live alone. Everyone must diligently save money!

The first step before saving money is determining a separate budget for saving and expenditures. It is also recommended that you save at the beginning of the month. Separate around 20% from your money is the best amount to save your pocket money or income.

Saving at the beginning of the month is wise because you will be ready to face unexpected expenditures if an emergency event suddenly comes at the end of the month.

For those who are still struggling to save money, Whizmin suggests that you save from the smallest nominal first. For example, if you get a monthly deposit of around 1 million Rupiah, you can save with a nominal value of 30 to 50 thousand first and increase it slowly but surely.

Later, if you are used to it, increase the budget, for example, to 100 to 150 thousand per month.

5. Cook Your Own Meals

If your boarding house has an adequate kitchen, use it well to cook. So, you don't need to buy food outside. You can cook your food to save your expenses by cooking it.

By cooking your food by yourself, you can also adjust it to your preferred taste. You also have new abilities. Later, you will be able to cook well if you rarely buy food outside.

Try to provide weekly groceries. That way, your expenses will be more effective and organized. Also, choose hygienic food, yes, so that you can still eat healthily and make sure your finances are safe.

6. Reduce Hangouts

Reduce the amount of hanging out with friends. This will lead to making you make consumptive habits. Try to make a schedule hanging out with your friends, for example once to three times each month.

Budget hanging out- You have to pay attention too. That way, you can still have fun if you already have a set budget.

7. Make Financial Records

Finally, for sure you have to make thorough financial records. Financial records are very important because it makes it easier for you to monitor your income and expenses. Moreover, nowadays, there are many easy-to-use financial applications, one of which is the Whiz financial application..

With the Whiz financial application. will easily monitor your income and expenses. In this application, you also have a limit on your spending. So, you can be more controlled in managing finances. Its features are also easy and practical so that it can make you interested in using it.

Thus, let's, use the Whiz financial application. so that you can be more financially literate!

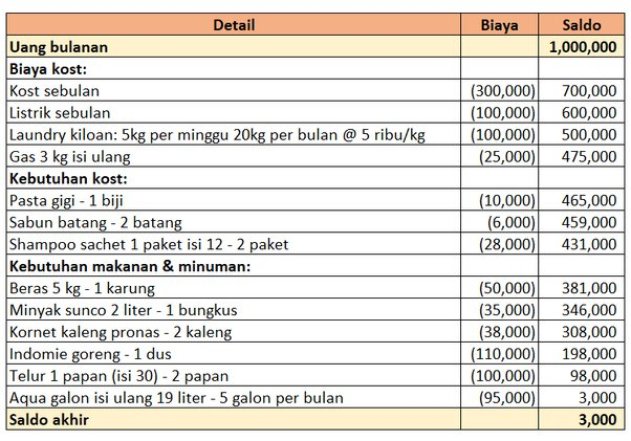

Example of Student's Financial Records cost

The picture above is just an example of financial records that record manually (not use any finance application). In the picture also does not have separated budget for saveing. You mustg grow a habit saving money to be ready for an emergency situation.

Read also: How to Manage Allowance for Interns

That's all a way to create financial records. Hopefully, this explanation can be helpful for those of you who want or have started living independently and applying to study away from home. Remember to use the Whiz financial application if you're going to record your finances practically.

You must be logged in to post a comment.